Bridge

Help clients plan for a secure financial future with Bridge®, a fixed index annuity (FIA) with a Long-Term Care Rider and the NeverStop® Health Coaching & Rewards Program.

Key Features:

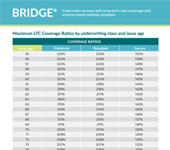

Your client chooses a Coverage Ratio to help them achieve the optimal balance between LTC benefit amount and growth of the annuity’s Accumulation Value — providing underlying product value even when the client doesn’t need LTC services. The Coverage Ratio ranges between 100% and a maximum that varies by age and underwriting class, and is applied to all premiums received in the first five years. (See calculator tool below.)

LTC coverage is guaranteed not to lapse and there are no ongoing premium payments. LTC Benefit Base grows at 3% annually for up to 20 years or time of claim, whichever comes first. The LTC benefit amount is determined at time of claim and paid monthly for 60 months until the Benefit Base is zero – even if the Accumulation Value is depleted (assuming no withdrawals).

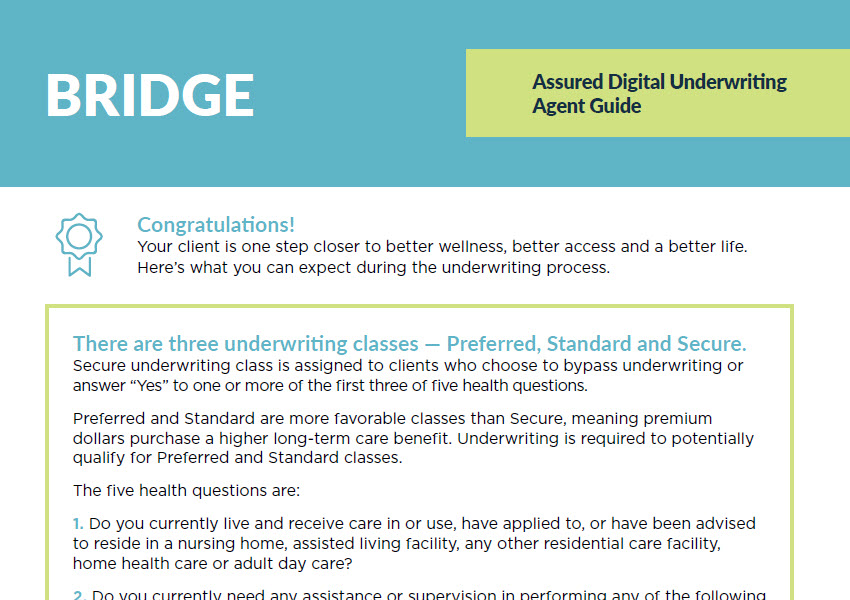

Underwriting for LTC coverage is quick and digital, and no one can be declined. There are three underwriting classes: Secure, Standard and Preferred. Your client can opt out of underwriting and accept Secure class, or boost their LTC benefit amount if they qualify for Standard or Preferred class. The annuity must pass suitability review.

LTC benefits are tax-free when used for qualified LTC expenses, subject to the daily IRS maximum. Payments are indemnity-based, meaning no receipts are required, and monthly payments begin once your client qualifies for benefits and the claim is approved. Annual certification is required to continue benefit payments. Your client may choose to stop benefit payments to preserve underlying annuity value and can restart based on need.

The robust, science-based NeverStop Health Coaching & Rewards Program, provided in partnership with Assured Allies, offers a customized Aging Map based on individual health goals and needs, along with access to a NeverStop Ally to provide personal support. Participation can help clients potentially reduce LTC expenses, but also earn wellness credits to increase LTC coverage. Member perks include resources, offers and discounts.

Rates and State Approvals

| Account Options | Current Rate |

|---|---|

| 1-Year Interest | 5.00% |

| S&P 500 1-Year Point-to-Point Cap | 9.00% |

| S&P 500 1-Year Point-to-Point Participation | 50.00% |

| S&P 500 1-Year Monthly Average Participation | 95.00% |

| Barclays Focus50 1-Year Point-to-Point Participation | 180.00% |

| S&P MARC 5% Excess Return 1-Year Point-to-Point Participation | 200.00% |

Marketing Materials

Agent Materials

Take me to: Client Materials

Bridge Agent Guide

Bridge Agent Underwriting Guide

Bridge Enhancements Overview

Bridge Underwriting What to expect

Bridge User Guide

Maximum Bridge Coverage Ratios

Bridge Prospecting & Funding Opportunities

Bridge AV vs LTC Benefit Base Flyer

Case Study - Carol

Case Study - Derek

Bridge Video

NeverStop Wellness Program Video

Underwriting Video - client approved

Bridge Explanation of Fees

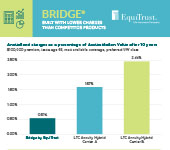

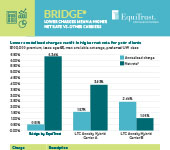

Bridge Higher Net Rate Flyer

Immediate tax-free LTC benefits

Bridge Quick Hits Agent Flyer

LTC Annuity Sales Presentation

NeverStop Program Overview Brochure

Client Materials

Licensing and continuing education (CE) requirements by state

Because of the long-term care component of Bridge, most states require a health line of authority and/or continuing education in order to solicit Bridge.

Learn MoreCalculator

Webinars

Upcoming

Replays

Building on Bridge® - Enhancements for the new year

Replay

Ready to add Bridge to your client’s long-term care strategy?

Access client information, run an illustration, fill out your application and learn more about underwriting.

Get Started Now

Getting Contracted

EquiTrust products are sold by independent agents who are contracted with us through independent marketing organizations. If you work with a marketing organization, please ask them to help you get contracted with EquiTrust.

If you need help finding a marketing organization or have questions, please call our Sales Support team at 866-598-3694 or click the Getting Contracted button.

Getting Contracted