Products

| Index Annuity with LTC |

Account Options | Current Rates (as of 01/24/2024) |

Surrender Charges | Ages | Premiums | LTC Benefits | Underwriting | NeverStop Wellness Rider | Fees | Additional Riders | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Bridge |

|

|

10-Year1

9, 8, 7, 6.5, 5.5, 4.5, 3.5, 2.5, 1.5, 0.5% |

55 - 801 |

Flexible

Minimum $2,000 Minimum Additional Maximum First-year Coverage2 |

Tax-free3

No receipts required Payable monthly |

Guaranteed approval

3 underwriting classes Ability to

opt-out

|

Automatically included1

Offers the Owner an individualized program to promote successful aging and the opportunity to earn additional LTC benefit credits through participation |

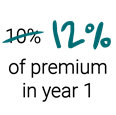

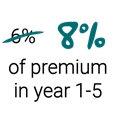

1% Premium Load2

Monthly LTC Rider Charge $100 Annual

Wellness Rider Charge

|

Nursing Home Waiver

Terminal Illness |

1 May vary by state

2 If Inflation Rider is chosen, the Maximum First-year Coverage decreases to $250,000 and the Premium Load is increased and varies by Issue Age and Risk Class

3 Long-Term Care Benefits are typically tax-free under Internal Revenue Code Section 7702B. Generally, the maximum tax-free Long-Term Care Benefit payable from all coverage on the same insured is limited to the greater of actual qualified Long-Term Care expenses or the per diem rate established by the IRS.

• Minimum Guaranteed Rates for Bridge: 1-Year Interest: 1.00%; 1-Year Pt-to-Pt Cap: 1.00%; 1-Year Pt-to-Pt Part: 10%; 1-Year Monthly Avg Part: 10%; 1-Year Pt-to-Pt Part MARC 5%: 10% ; 1-Yr Pt-to-Pt Part Focus 50: 10%

• Free Withdrawals on Bridge: Interest only 1st contract year, 10% of Account Value years 2+

• Minimum Guaranteed Contract Value on Bridge : 87.5% of premium minus withdrawals, less monthly LTC rider charges, accumulated at the Minimum Guaranteed Contract Rate (no lower than 1% and no higher than 3%).

| Index Annuities | Premium Bonus | Account Options | Current Rates (as of 01/24/2024) |

Surrender Charges | Ages | Premiums | Riders | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| MarketPower Bonus Index |

|

|

|

14 Years1

20, 20, 19, 19, 18, 17, 16, 14, 12, 10, 8, 6, 4, 2% |

0 - 75 |

First Year Only

Minimum Minimum Additional Maximum |

Income Rider with Chronic-Illness Doubler

Nursing Home Waiver3 Terminal Illness |

||||||||||||||||||||

| MarketTen Bonus Index |

|

|

|

10 Years1

10, 10, 10, 10, 8.5, 7, 5.5, 4, 3, 1.5% |

0 - 80 |

Flexible

Minimum Minimum additional Maximum

|

Return of Premium

Income Rider with Chronic-Illness Doubler Nursing Home Waiver3 Terminal Illness |

||||||||||||||||||||

| MarketValue Index |

|

|

|

10 Years1

12, 12, 12, 12, 11, 10, 8, 6, 4, 2% |

0 - 80 |

Flexible

Minimum Minimum additional Maximum |

Income Rider with Chronic-Illness Doubler

Nursing Home Waiver3 Terminal Illness Waiver |

||||||||||||||||||||

| MarketSeven Index |

|

|

|

7 Years1

9, 8, 7, 6.5, 5.5, 4.5, 3.5% |

0 - 85 |

Flexible

Minimum Minimum additional Maximum

|

Income Rider with Chronic-Illness Doubler

Nursing Home Waiver3 Terminal Illness Waiver |

||||||||||||||||||||

| MarketFive Index |

|

|

|

5 Years1

9, 8, 7, 6.5, 5.5% |

0 - 90 |

Flexible

Minimum Minimum Additional Maximum

$2,000 Additional

|

Nursing Home Waiver3

Terminal Illness Waiver |

1 May vary by state

2 Maximum cumulative premium for all products is $2,000,000, including any inforce life policies or annuity contracts. Higher amounts require Home Office approval.

3 Available through age 80

• Minimum Guaranteed Rates for Index Annuities: 1-Year Interest: 1.00%; 1-Year Pt-to-Pt Cap: 1.00%; 1-Year Pt-to-Pt Part: 10%; 1-Year Monthly Avg Cap: 1.00%; 1-Year; Monthly Avg Part: 10.00%; 1-Year Monthly Cap: 0.50%; 2-Year Monthly Avg Cap: 3.00%; 1-Year Pt-to-Pt Part MARC 5%: 10% ; 1-Yr Pt-to-Pt Part Focus 50: 10%; 2-Yr Pt-to-Pt Part Focus 50: 10%

• Free Withdrawals on Index Annuities: Interest only 1st contract year, 10% of Account Value years 2+

• Minimum Guaranteed Contract Value for all Index Annuities except MarketTen Bonus : 87.5% of premium minus withdrawals, accumulated at the Minimum Guaranteed Contract Rate (no lower than 1% and no higher than 3%).

• Minimum Guaranteed Contract Value for MarketTen Bonus: 100% of premium minus withdrawals, accumulated at the Minimum Guaranteed Contract rate (no lower than 1% and no higher than 3%), less surrender charges.

| Rate Buy-Up Index Annuities | Premium Bonus | Account Options | Current Rates (as of 01/24/2024) |

Annual Fee | Surrender Charges | Ages | Premiums | Riders | |||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

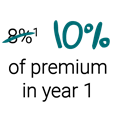

| MarketForce Bonus Index |

|

|

|

|

10 Years1

16, 14.5, 13, 11.5, 9.5, |

0 - 80 |

First Year Only

Minimum Minimum additional Maximum |

Nursing Home Waiver3

Terminal Illness Income Rider Not Available |

|||||||||||||||||||||||||||

| MarketMax Index |

|

|

|

|

10 Years1

9, 8, 7, 6.5, 5.5, 4.5, |

0 - 80 |

Flexible

Minimum Minimum additional Maximum |

Nursing Home Waiver3

Terminal Illness Income Rider Not Available |

1 May vary by state

2 Maximum cumulative premium for all products is $2,000,000, including any inforce life policies or annuity contracts. Higher amounts require Home Office approval.

3 Available through age 80

• Minimum Guaranteed Rates for Index Annuities: 1-Year Interest: 1.00%; 1-Year Pt-to-Pt Cap: 1.00%; 1-Year Pt-to-Pt Part: 10%; 1-Year Monthly Avg Cap: 1.00%; 1-Year; Monthly Avg Part: 10.00%; 1-Year Monthly Cap: 0.50%; 2-Year Monthly Avg Cap: 3.00%; 1-Year Pt-to-Pt Part MARC 5%: 10% ; 1-Yr Pt-to-Pt Part Focus 50: 10%; 2-Yr Pt-to-Pt Part Focus 50: 10%

• Free Withdrawals on Index Annuities: Interest only 1st contract year, 10% of Account Value years 2+

• Minimum Guaranteed Contract Value for MarketForce Bonus and MarketMax : 87.5% of premium minus withdrawals, accumulated at the Minimum Guaranteed Contract Rate (no lower than 1% and no higher than 3%).

| Multi-Year Guarantee Annuity | Ages | Premium | Guarantee Period | Current Rates (as of 02/16/2024) |

Surrender Charges | Free Withdrawals | Death Benefit | Riders | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Certainty Select | 0-90 |

Single

Minimum Maximum |

|

|

10, 10, 9%2 10, 10, 9, 9, 8%2 10, 10, 9, 9, 8, 8%2 10, 10, 9, 9, 8, 8, 7, 7%2 10, 10, 9, 9, 8, 8, 7, 7, 6, 5%2 |

Cumulative Interest Beginning Immediately | Full Accumulation Value |

Nursing Home Waiver3

Terminal Illness |

1 Maximum cumulative premium for all products is $2,000,000, including any inforce life policies or annuity contracts. Higher amounts require Home Office approval.

2 May vary by state

3 Available through age 80

• Minimum Guaranteed Contract Value for Certainty Select : 87.5% of premium minus withdrawals, accumulated at the Minimum Guaranteed Contract Rate (no lower than 1% and no higher than 3%).

| Traditional fixed Annuity | Ages | Premiums | Premium Bonus | Current Rates (as of 02/16/2024) |

MVA | Surrender Charges | Free Withdrawals | Riders | ||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

0-85 |

First Year Only

Minimum Maximum |

|

|

|

|

|

Nursing Home Waiver4

Terminal Illness |

1 Maximum cumulative premium for all products is $2,000,000, including any inforce life policies or annuity contracts. Higher amounts require Home Office approval.

2 May vary by state

3 By Current Company Practice

4 Available through age 80

• Minimum Guaranteed Contract Value for ChoiceFour: 100% of premium minus withdrawals, accumulated at the Minimum Guaranteed Contract rate (no lower than 1% and no higher than 3%), less surrender charges.

| Single Premium Immediate Annuity | Ages | Annuity Options | $100,000 Premium | Minimum Payment | Payment Modes | Premium | Additional Notes | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Current Rates (as of 08/17/2023) |

Monthly Payment | |||||||||||||||||||||

| Confidence Income Annuity |

0-90

0-85

|

Fixed Period

5-20 Years Single & Joint Life

|

|

|

$100 |

Monthly Quarterly Semi-Annually Annually |

Single

Minimum Maximum |

Payments may vary in states with Premium Tax:

CA, CO, ME, NV, SD, WY Life payments may vary by qualified type

|

||||||||||||||

1 Maximum cumulative premium for all products is $2,000,000, including any inforce life policies or annuity contracts. Higher amounts require Home Office approval.